8666201302: Key Factors for Picking Profitable Stocks

In the realm of stock selection, understanding key financial metrics is essential for investors seeking profitability. Key ratios such as price-to-earnings and profit margins offer insights into a company’s operational efficiency. Market trends also play a crucial role, as they can influence stock performance significantly. However, the analysis does not stop there; evaluating company fundamentals and management quality adds another layer of depth. These factors collectively shape an informed investment strategy that warrants further exploration.

Understanding Financial Metrics

Financial metrics serve as critical indicators for investors assessing the performance and potential of a stock.

Key financial ratios, such as the price-to-earnings ratio and return on equity, provide insights into a company’s efficiency and profitability.

Additionally, analyzing profit margins reveals how well a company converts revenue into profit, enabling investors to make informed decisions about potential investments and overall financial health.

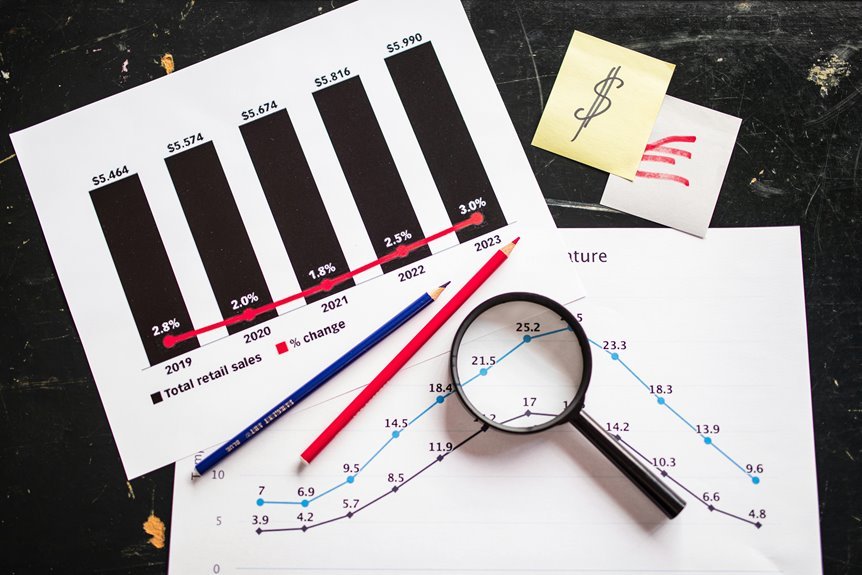

Analyzing Market Trends

How do market trends influence stock performance?

Market trends provide vital insights into potential stock movements, informing investors’ decisions.

Technical analysis employs historical price data to identify patterns, while sentiment indicators gauge investor emotions, revealing market psychology.

Evaluating Company Fundamentals

Understanding market trends lays the groundwork for evaluating company fundamentals, which are pivotal in determining a stock’s long-term viability and growth potential.

Investors must focus on assessing management quality and their strategic decisions, as effective leadership often correlates with success.

Furthermore, identifying a company’s competitive advantage can provide insights into its market position, sustainability, and ability to generate future profits.

Conclusion

In the intricate tapestry of stock selection, discerning investors weave together financial metrics, market trends, and company fundamentals to illuminate profitable opportunities. By meticulously assessing ratios and delving into the nuances of management quality and competitive edges, they navigate the complexities of the market landscape. This judicious approach not only enhances the potential for rewarding returns but also cultivates a shield against unforeseen risks, ultimately guiding investors toward a more prosperous financial horizon.